Euro Analysis: (EUR/USD, EUR/GBP, EUR/CHF)

- EUR/USD encapsulates the forces of a stronger USD and weaker euro

- Bank of England to tee up rate cut this summer?

- Will the SNB cut rates again despite Chairman Jordan’s currency comments

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

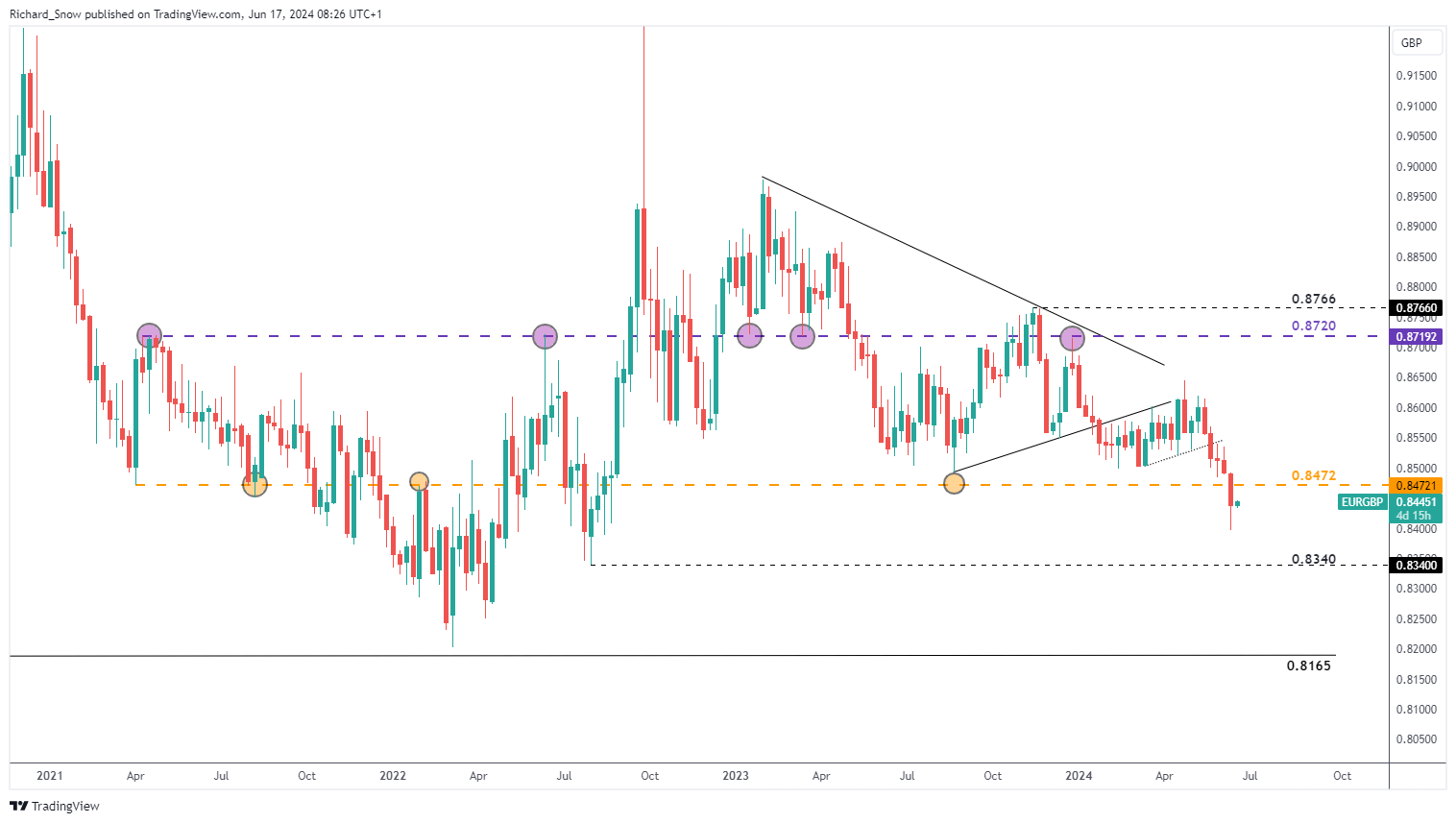

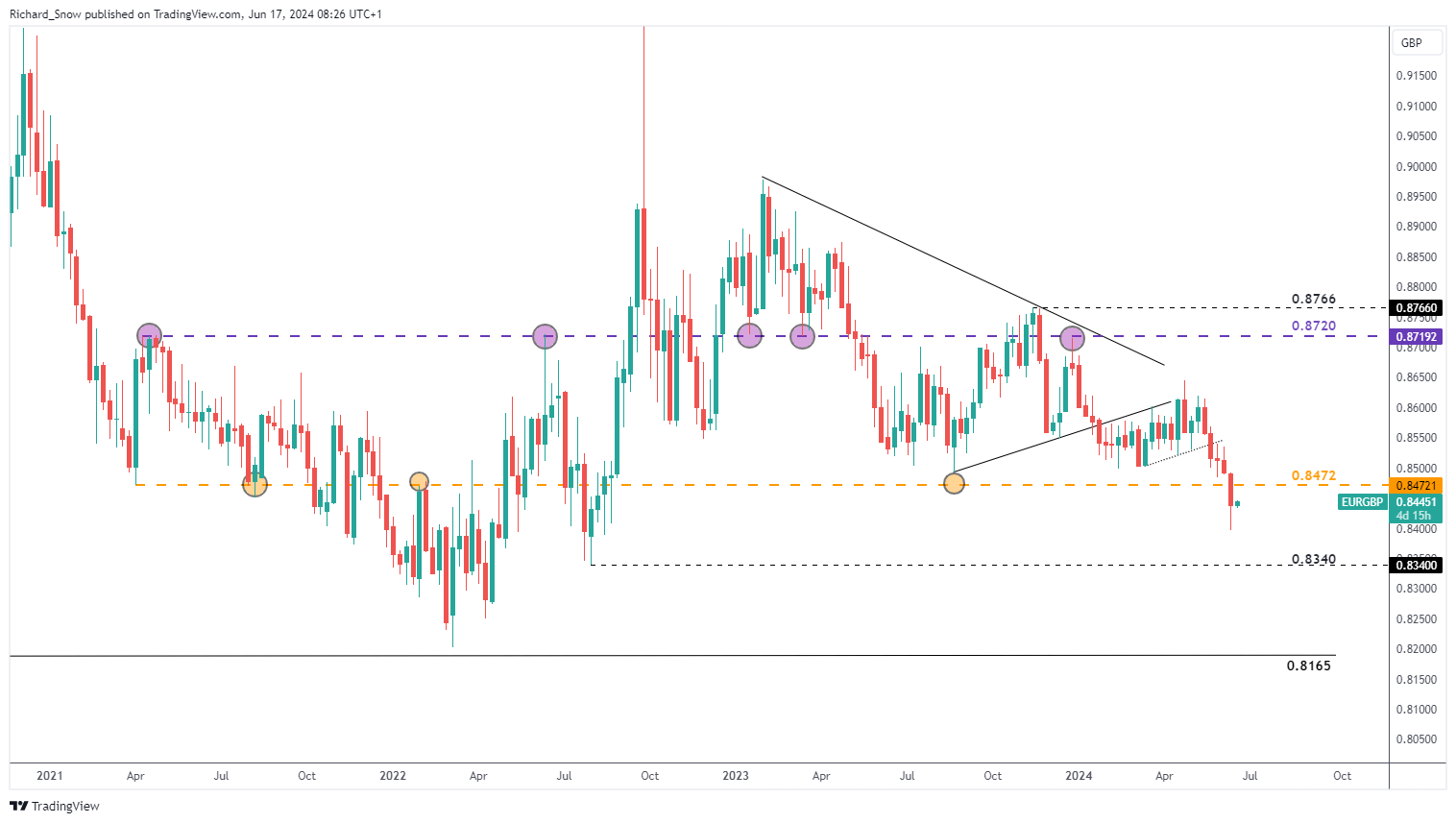

UK data returns to prominence this week with headline and core inflation expected to build on progress made in April but the Bank of England (BoE) remain laser focused on services inflation. Not long after UK CPI we have the BoE statement and press conference. Market consensus dictates that we’ll see another hold from the Bank but recent easing in the jobs market coupled with a stagnant economy in April could see the Monetary Policy Committee (MPC) tee up a rate cut for the summer.

Customize and filter live economic data via our economic calendar

Alongside the BoE decision on Thursday, we’ll also get the Swiss National Bank rate decision. Markets expect another cut following the surprise cut in March, but Chairman Thomas Jordan has complicated this view after he mentioned the biggest threat to the inflation outlook is a weaker franc. Lower interest rates generally precede a period of depreciation in the local currency.

Learn how to prepare for high impact economic data or events with this easy to implement approach:

EUR/USD Encapsulates the Forces of a Stronger USD and Weaker Euro

Euro dollar experienced a volatile week initially rising after encouraging US CPI data but then upward revisions to both the Fed funds and inflation outlooks spurred on the US dollar into the weekend.

The pain encapsulates 2 forces at work with the first being a stronger U.S. dollar upon recent Fed forecast revisions, and the second being a vulnerable euro in the wake of political uncertainty in France. We've seen a flight to safety in the European bond market led by German Bunds - inflating the risk premium across Europe which historically has led to a weaker currency.

This week we look to the 1.0700 for a potential pause in recent selling. Neither of the two currencies have major data releases planned for the week, offering up the potential for a reprieve for EUR/USD although, the RSI has not yet reached oversold conditions – something bears will be aware of. The pair will likely take its cue from political developments and the bond market this week.

EUR/USD Daily Chart