USD/JPY, Yen Analysis

- FX intervention rhetoric shifts up a gear

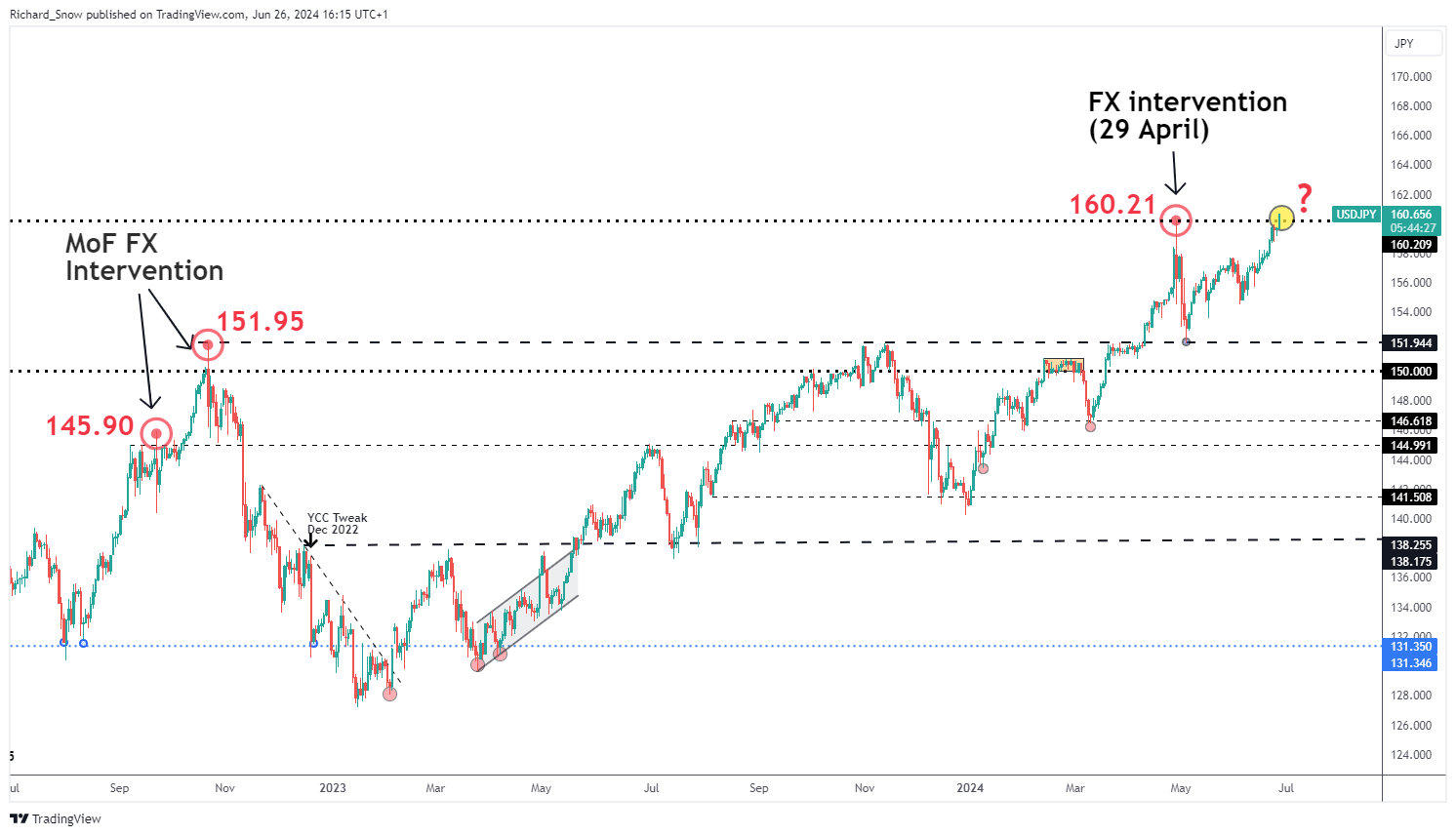

- USD/JPY completely disregards the fall in US-Japan bond spreads to trade higher

- Markets appear to be calling the bluff of Japanese officials as each intervention level has been surpassed since 2022 interventions

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Japan’s Top Currency Official Declares Recent Yen Weakness 'Not Justified'

Japan’s top currency official Masato Kanda from the Ministry of Finance (MoF) issued his sternest warning yet against undesirable, speculative moves in the FX space. However, markets appear happy to call his bluff seeing that USD / JPY has moved effortlessly beyond prior levels where intervention took place.

Kanda mentioned he is seriously concerned about the recent rapid weakness of the yen which is getting closer to the 4% gauge relied upon previously to judge a ‘rapid’ and undesirable decline in the currency. Ahead of the April FX intervention, Kanda clarified a 4% depreciation over a two-week period or a 10% decline over a month meets the definition. Since the May swing low, the yen had depreciated around 3.15% in the space of two weeks, getting close to the 4% rule of thumb.

USD/JPY traded to an intra-day high (London session) at the time of writing at around 160.81 and has breached into oversold territory on the RSI.

USD/JPY Daily Chart